Context for Chatgpt: After several months of stagnation, the bitcoin course began ascending movement at the end of April until they returned to the symbolic bar of $ 100,000 to the symbolic bar.

In addition, the data from the product market derived from bitcoins is intensified. Analysts are now concerned about the potential of even greater liquidation waves.

Long positions increase with the increase in bitcoins

According to Coinglass data, approximately 190,000 traders were liquidated, total losses that reached $ 970 million. Short positions were most affected by losses of $ 836 million. This event means the greatest disposal of short positions since 2021. Corkends also noted that the actual data could show even higher.

“It is the largest disposal of short positions since 2021 … Binance has not fully published its liquidation data and the actual data is higher,” Corclass said.

Although short positions have been destroyed, the market faces a new risk: a sharp increase in long positions.

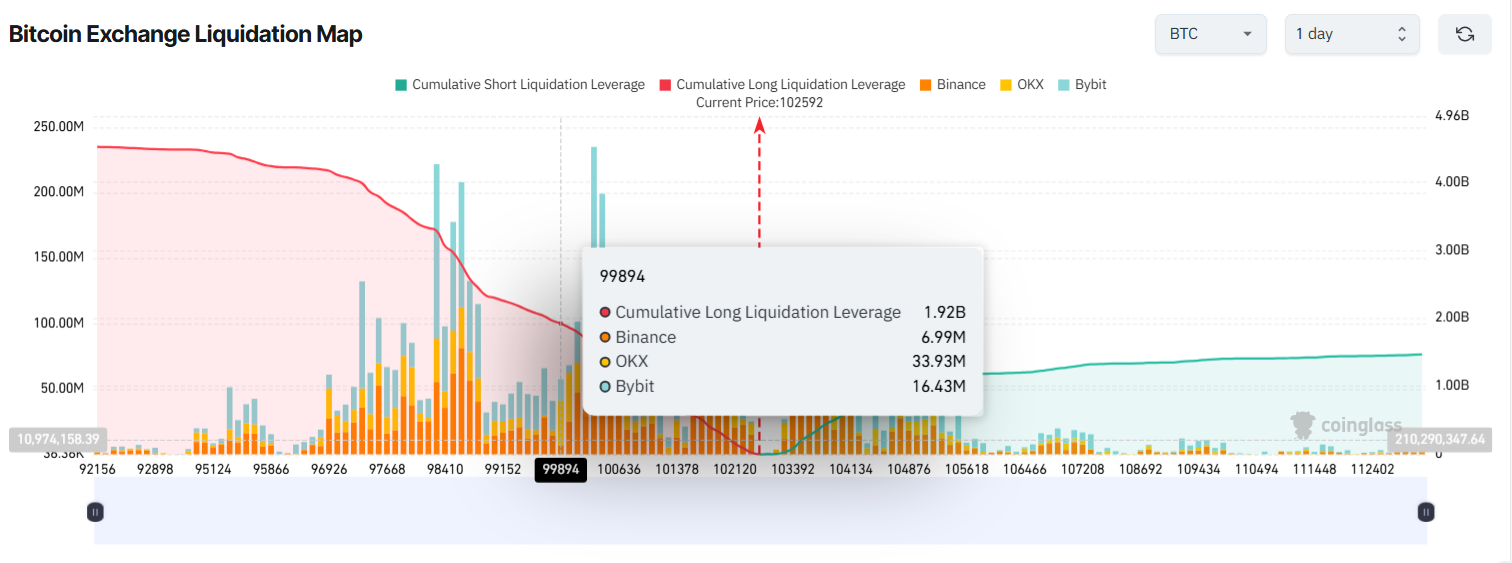

After 24 hours, the Map of Bitcoin Bitcoins shows that if a bitcoin course falls below $ 100,000, the total long position on the platforms could cope with almost $ 2 billion in liquidation. This raises concerns about the potential “pressing of shorts”, a phenomenon where massive disposal of long positions starts panic sales and speeds up a fall in prices.

The same card also shows that if bitcoins drop below $ 98,000, the total disposal volume could reach up to $ 3.45 billion.

Moreover, this stunning potential for the disposal of long positions suggests a change in the feeling of traders. In fact, many bet more money and use a higher lever effect because they expect a prolonged increase in bitcoins.

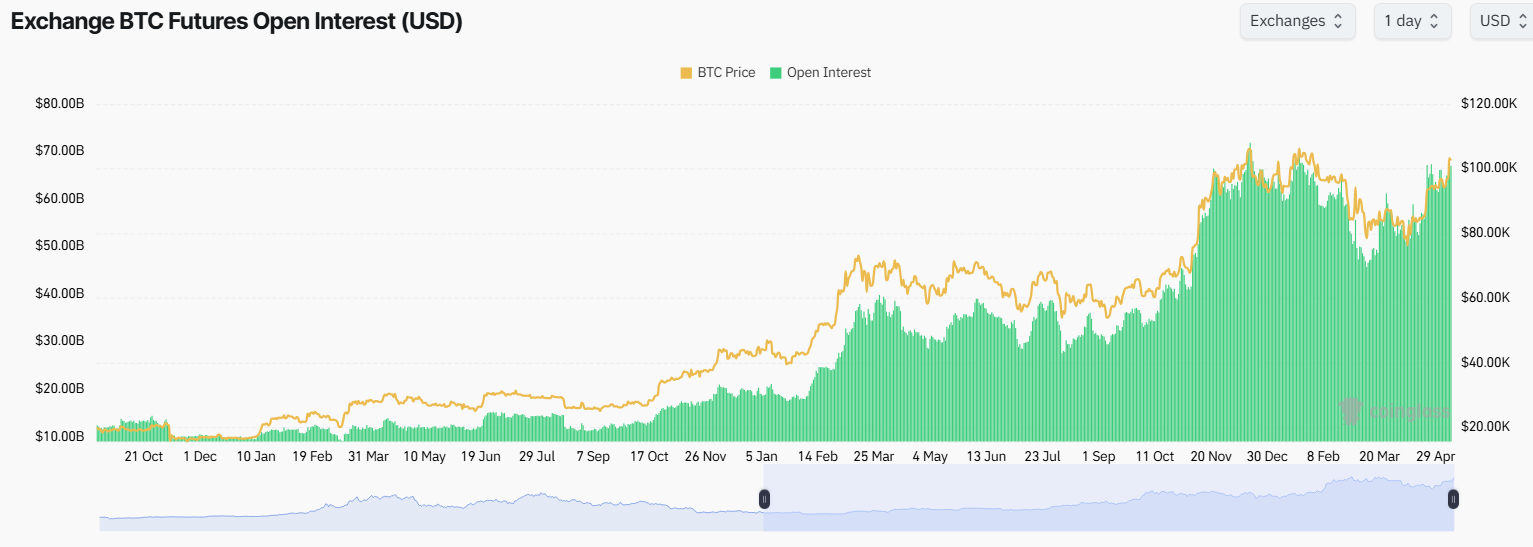

In addition, Data Quince shows that open interest (OI) of future bitcoins on platforms has reached a record of $ 67.4 billion. This reflects the increase in demand for short -term lever trading. Traders take large bets on an ascending trend, which increases the risk if the market suddenly turns.

Historically, whenever Bitcoin Oi exceeded $ 65 billion, shortly thereafter, market correction followed.

Bitcoin now makes subtitles not only to exceed $ 100,000 again, but also for increasing influence on global finances. In one place Bitcoin even crossed Amazon to become the fifth largest asset in the world, with a market capitalization of $ 2.05 trillion. In parallel standard Chartered, it predicts that Bitcoin could soon return to his historical summit and reach $ 120,000 during the second quarter of the year.

Morality History: Increasing Bitcoin not only makes people happy.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.