In 2023, Bitcoin (BTC) recorded its best performance since 2020. At the same time, a record number of cryptocurrencies were withdrawn from the market in 2023. “tidy” ? Are the conditions for upward recovery met? While the halving will arrive in the spring of 2024, exchange platform SwissBorg, which has up to 700,000 verified users, has revealed its outlook for 2024.

The price of Bitcoin (BTC) is rising significantly

Many bullish elements have accumulated during 2023: Cryptocurrencies: Bull Market in 2024? – Cointribune. Indeed, the release of long rates and “back to normal” in the face of the bearish moves of 2022, they supported a quick bullish recovery. The price of Bitcoin (BTC) rose from less than $17,000 in January 2023 to over $44,000 in December (+170% approx). An exceptional trend that gives all operators hope for its continuation in 2024…

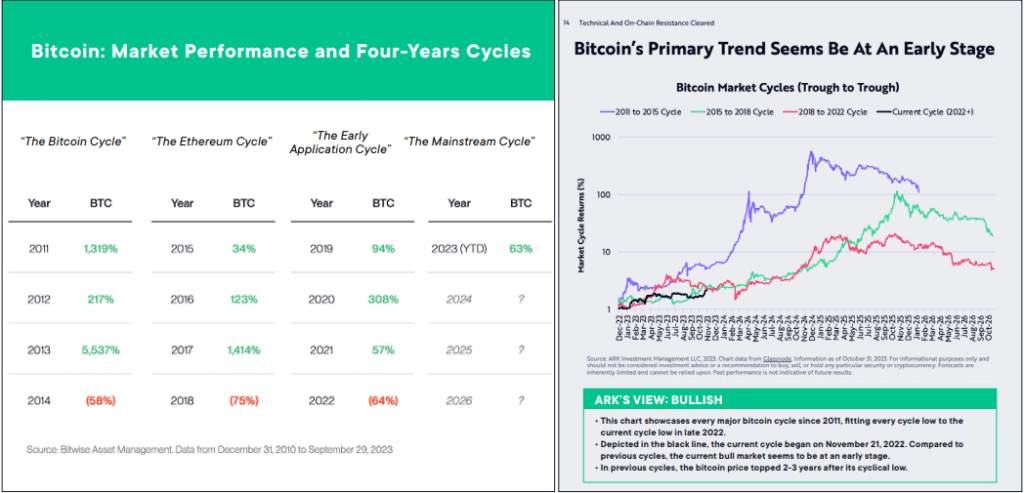

For SwissBorg, “2023 is very likely to be a post-bull market year, marking the beginning of the famous 4-year cycle”. It is indeed remarkable that the increase observed since the beginning of 2023 is part of the first part of an average upward phase of 2.5 years. The symmetry with previous upward movements is evident (see below):

According to the time distribution proposed here, the average performance of the second year of the cycle would be around +200%. The large variability of this performance also requires that this observation be read with caution. Despite all that, it might make some people expect a target above $100,000 for Bitcoin (BTC). As a result, this new Bitcoin (BTC) cycle could be a cycle-driven democratization of cryptocurrencies.

“Bear Markets Create Builders, Builders Create Bull Markets”

“What we love most about Bear Markets is the noise-canceling effect that allows only projects with a clear and strong intent to stand out. »

SwissBorg Crypto Report 2024: End of the Bear Market?

Source: Introducing Hocus Pocus: Crypto Report for 2024 (swissborg.com)

The 2022 bear market lasted exactly 1 year, which is the historical norm. The decline seen in 2022 hit the market sentiment hard in 2023. Furthermore, the market decline seems to have been relatively larger “intensive” than in the past. Really, ” Production cost » of bitcoin and the number of cumulative addresses in the bitcoin network were briefly lower than the price of bitcoin, as well as the long moving average.

Added to this are scandals and regulation. Both the FCA and the European Union have initiated a tightening of regulation, particularly with the launch of the MiCA project. At the same time, the trial of Sam Bankman Fried after the FTX bankruptcy helped the market turn the page on the disasters of 2022. But we had to wait for Bitcoin ETF rumors to confirm the change in market phycology. As was the case in late 2020 with Elon Musk, MicroStrategy and others, it is likely that the intervention of several actors to positively change the phycology of the market.

Events that will take place in 2024

- Halving, which will reduce Bitcoin miners’ rewards by 2, will go into effect in April 2024 (estimated March 30 or April 1). The reward per block will thus drop to 3,125 BTC.

- The United States will have to finance almost 31% of all its debtwhich could weigh on bond yields and financial markets (liquidity constraints).

- Stabilization of key central bank rates could benefit markets. This is because cryptocurrency bull markets generally require significant liquidity. Fed rates could be cut by as much as 100 basis points. Arthur Hayesco-founder of BitMEX & CIO Maelstrom, thinks so “we could be heading for the biggest bull market ever”.

- The SEC decision on the validation of Bitcoin ETF (BTC) could be published on January 10, 2024. This decision is expected to have a positive impact on the market. However, too much bullish optimism, potentially already baked into prices, would only have a limited effect.

- Technical configuration bitcoin for 2024 would be potentially favorable (RSI, moving averages, etc.). The SwissBorg report highlights the good odds of this prospect.

- The US election will take effect on November 5, 2024. The months leading up to the US election are known to be generally very bullish on financial markets.

- The number of cryptocurrency users worldwide could exceeds 500 million people. In 2023, it is estimated that around 420 million people will be using cryptocurrencies.

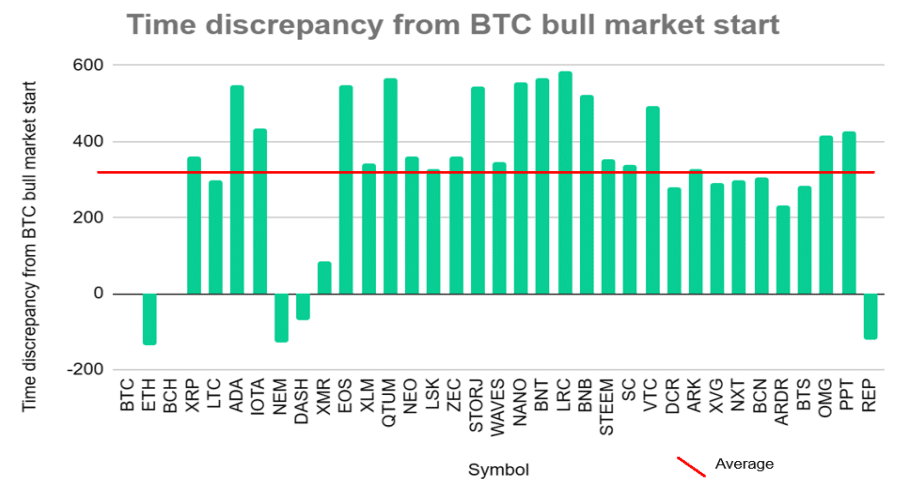

The duration and structure of bull markets

This is revealed by an exclusive report from SwissBorg “Altcoin bull market started on average 1 year later than Bitcoin”. In addition, “Altcoin bull market duration also averages 300 days shorter than Bitcoin”. So far, however, Ethereum has been the exception and remains an asset that is fairly in sync with Bitcoin’s movements.

Ideally, it is accompanied by a bull market “in fact” by several identical phenomena:

- Growing number of userswhich means more demand from minors.

- We observe symmetrically for a long time increasing mining difficulty and hash rate.

- Consequently, it is generally translated of ” production costs “ higher. Any permanent deviation between “Production Price” of bitcoin and its price may show an excess signal.

So we can hope that the rise of Bitcoin in recent months will gradually be followed by altcoins, even though the biggest ones have generally already climbed.

2024: the year “all hopes” ?

So 2024 has a chance on its side to show legitimate hopes. 2023 actually eased the fears and sufferings of the crypto community. But the risks are that we will see 2024 open with hope and close with euphoria… And as the Italian proverb says, “He who lives in hope dies in desire”. As the famous investor Benjamin Graham wrote, the higher prices rise, the more caution and selection is needed. The smart investor, while often afraid of the risk associated with cryptocurrencies, knows how to consider them in an aggressive strategy.

| Active | Annual performance as of 23/12/2023 |

| gold (USD) | +12.58% |

| S&P 500 | +24.33% |

| BTC/USD | +163.18% |

| ETH/USD | +90.82% |

| MSCI World | +17.51% |

| EUR/USD | +2.91% |

So it seems that a new cycle in Bitcoin is indeed underway. The economic, financial and psychological context could be favorably oriented. In fact, the same hopes can appear in stock markets or other assets such as gold. The S&P 500, which reached its last peak in January 2022 at 4,820 points, is on the verge of breaking its records. Anyway, the price of gold is trying to surpass its all-time highs, last recorded on December 4, 2023 at nearly $2,150 per ounce. Gold prices have been stagnant for 3 and a half years, with stock indices for almost 2 years.

The start of 2024 promises to be an intense…

The end of 2023 was surprising with the speed of rise of many cryptocurrencies. As usual, this increase heralded a bullish recovery in traditional assets. Liquidity is gradually returning and risk aversion is decreasing. The year 2024 begins with hopes that are all the more difficult to satisfy because the rise has already begun…. Therefore, the main question that worries analysts and market players is to know how far this new era will go… In this regard, the SwissBorg report offers a good sign.

Finally

Market participants are finally confirming a potentially favorable outlook for 2024. Behavioral finance teaches us that any disappointment in the face of this expectation can lead to an even more negative reaction. But for now, all rational hopes are oriented favorably. The psychology of the market is gradually becoming optimistic, and without turning into euphoria, the rising breeze is getting stronger.

2024 is expected to start with Bitcoin ETF news, an event that will grab the attention of the market. Cuts and base rates should further boost market sentiment. The US election will also be very important in the second half of 2024. Ultimately, this new cycle could benefit from an environment of democratization of cryptocurrencies and release of liquidity. Remember that the last all-time high of Bitcoin (BTC) was reached on November 10, 2021 at almost $69,000.

As Bitcoin is correlated with traditional markets, assets such as gold or stocks also show a favorable trend. The year 2024 will thus show which assets will outperform the general trend. Higher performance is a major concern for Bitcoin, which is still struggling to establish itself as a core asset.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

Author of several books, economic and financial editor for several sites, over many years I have developed a real passion for analyzing and studying markets and economics.

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.