20:00 ▪

9

min reading ▪ acc

The end of the year is fast approaching and several factors have marked the year that has just passed for Bitcoin. We take this opportunity to highlight these key elements and look at possible Bitcoin predictions for 2024.

The most important bitcoins for 2023

During 2023, there were several catalysts that had a strong impact on Bitcoin. We will highlight some of these key points.

In March 2023, after a crisis in regional banks, the Fed came to the rescue to avoid a cataclysm. Bitcoin, which is highly linked to liquidity, reacted positively. Another key element of the year was the slowdown in inflation, which improved consumer sentiment. When sentiment improves, it encourages investors to take more risks.

Another catalyst that really drove Bitcoin price action in 2023 remains the pending SEC approval of the Bitcoin spot ETF. Each speculation generated peaks of volatility upwards as well as downwards.

Bitcoin cyclicality

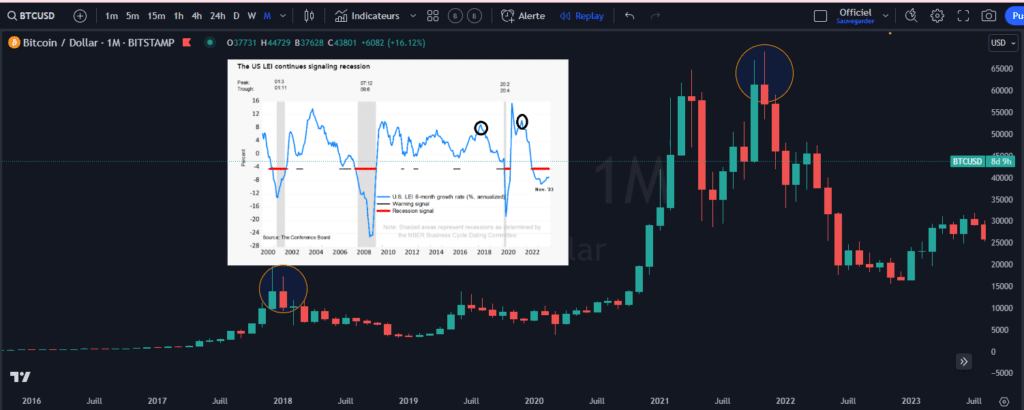

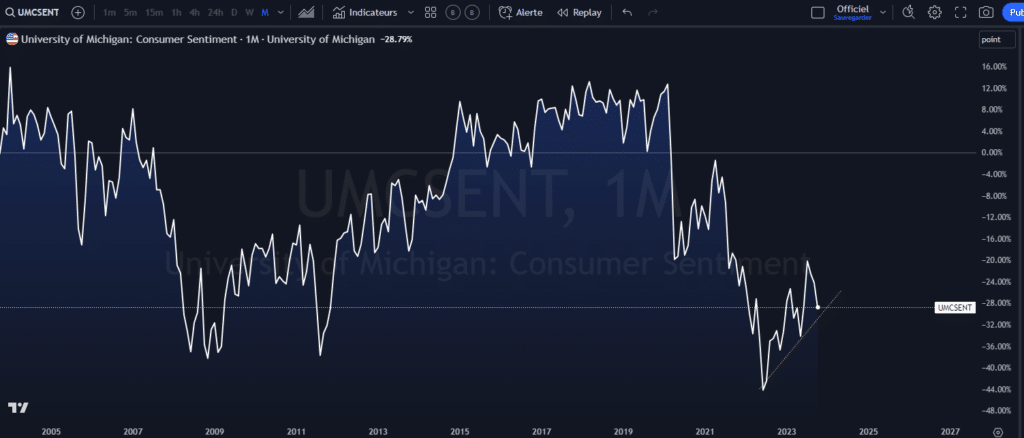

Like most assets, Bitcoin is fairly cyclical. This means that it consists of well-defined bullruns and bear markets. These cycles are often similar to cycles of acceleration and deceleration of economic growth. Additionally, Bitcoin is often one of the assets that gives the first signal of a bullish cycle peak, as it is often the first to fall. Every bear market corresponds to a peak of growth followed by the beginning of an economic slowdown. This can be seen in the graph below:

Generally speaking, bear market cycles for Bitcoin are around 2 years. This means that the downtrend can last for 2 years. Bullrun cycles are shorter.

The last bear market started at the end of 2021 with a day in October 2022. So we can deduce that the bear market cycle is over as it has been 2 years already.

Pivot expectations

The years 2022 and 2023 were marked by inflation, geopolitical problems and monetary policy. Of course, these factors influence investor behavior, which has led to a great deal of consumer and investor reluctance. The latest statement from the central bank FED made it clear that we are on top of rate hikes and that they are likely to make several rate cuts during 2024. This expectation of a swing during the 4th quarter of 2023 has led to excitement in all financial markets.

Impacts of the economic environment

We will not have to disappoint the markets if we want to support the continuation of the movement. This means that we will have to stay within the logic of a soft landing, assuming an environment of stable growth, ever-decelerating inflation and a resilient labor market. All this will contribute to the further improvement of consumer sentiment and thereby attract investors. The worst-case scenario would be a worsening of the economy with lagged effects of monetary policy. This is also why central banks have decided to take a break for the time being. In this spirit, we need to know the reason why the FED wants to pivot:

- A drop in inflation?

- Rising unemployment?

- Liquidity crisis?

As for the drop in inflation, if it is not due to negative growth (deterioration of the economy + increase in unemployment), it can confirm soft landing. In the event of a hard landing, everything will depend on the extent of the lagged effects of monetary policy on the economy. The data that will make the difference between a soft or hard landing will be the labor market. So this is data that will need to be watched carefully for predictions. At the moment, we have some resilience in terms of employment:

The effects on the financial markets and Bitcoin will also depend on the valuation at the time. If valuations are very high without an economic recovery to justify that recovery, and we have the beginnings of a rise in unemployment, there could be a more significant correction in valuations at that time because all the growth was expected in a soft landing that won’t happen.

Bitcoin analysis from a general perspective

There are several factors that can affect Bitcoin predictions in 2024. Here are a few of them:

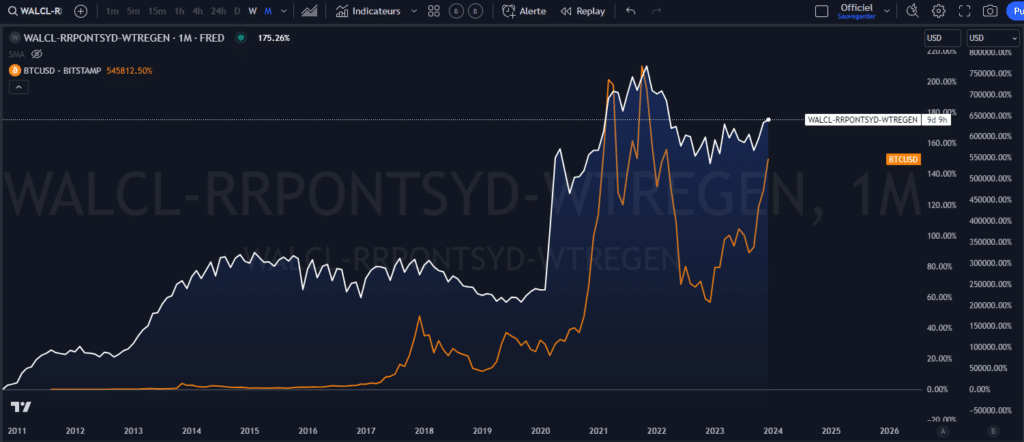

- Liquidity

- Supply, Demand (total supply of 21 million bitcoins)

- Consumer sentiment

- Economic context (growth, inflation, labor market)

- External events (positive or negative catalyst)

- American dollar

- Halving

In terms of liquidity, we can see that the current liquidity is quite bullish, which is positive for Bitcoin. In the context of the recession, this should also increase and ultimately be a positive element for Bitcoin.

Another important event for 2024 is halving which allows the available supply to decrease, which tends to be positive for Bitcoin as well. The cyclicality of halving every 4 years is often associated with an average business cycle of 5 years.

With inflation slowing, consumer sentiment has improved.

The eventual approval of a spot ETF risks being a positive element in the long run, as it will help attract more flows and further democratize Bitcoin.

In terms of the economic context, everything will depend on the economy’s ability to withstand the lagged effects of monetary policy. For now, if the unemployment rate remains resilient, it’s a positive for the economy.

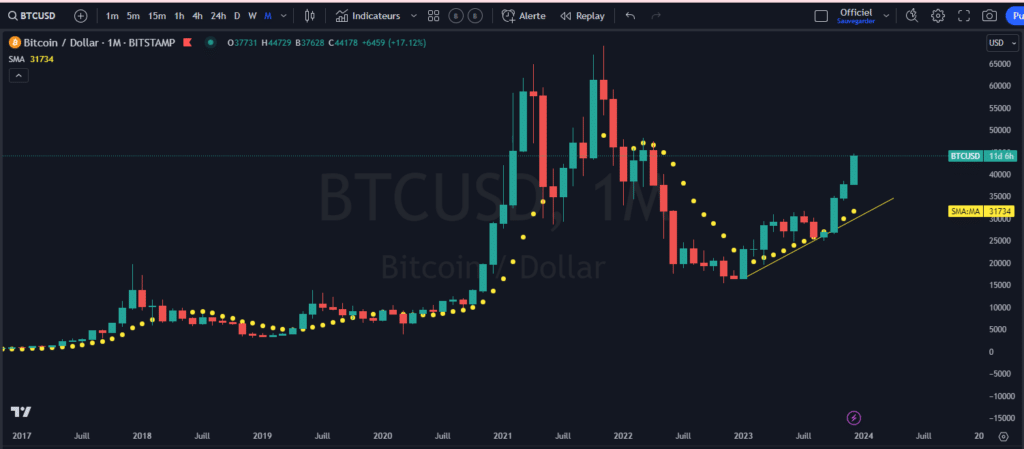

Bitcoin Technical Analysis

On the Bitcoin forecast from a technical order and on a long-term basis, Bitcoin is above the 10-month moving average, which remains technically bullish. Even though we have excessive deviations between the price and the moving average, we can see that the trend is still intact. So downloading remains a buying opportunity.

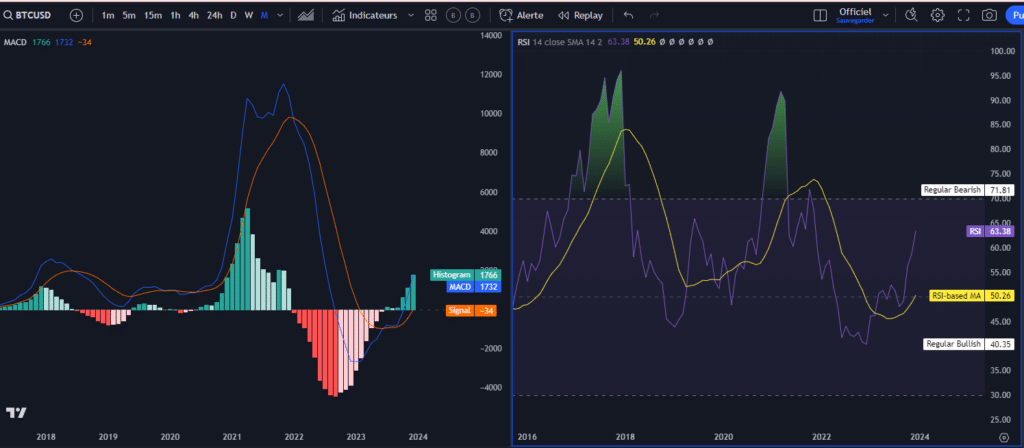

The MACD trend indicator is still in technical order and is still in positive momentum. On the other hand, the RSI oscillator still remains above the 50 zone (bullish trend), but still far from the long-term overbought zone.

Possible Bitcoin Predictions for 2024

The best buying zones on Bitcoin remain lateral zones. This means when volatility decreases and price stabilizes in a sideways band after a bear market. Here are some examples:

So there is a high probability that the bottom for this cycle is behind us. And structurally and fundamentally speaking, Bitcoin remains bullish for the long term. Here are the possible scenarios:

Optimistic scenario : a soft landing is confirmed next year and Bitcoin may persist towards ATH. At first bitcoin could test 65 thousand and then 80 thousand, 100 thousand. This type of scenario assumes stable growth, a fall in inflation without an increase in unemployment.

A pessimistic scenario : Economic data will deteriorate after monetary policy easing and Bitcoin could return towards 25,000-30,000 if consumer sentiment deteriorates. This kind of scenario could be possible if the unemployment rate increases.

CONCLUSION

In general, Bitcoin forecasts are structurally bullish. Its utility and rarity (21 million bitcoins) make it a unique asset. And like any asset, Bitcoin goes through various cycles. We can also add that the bear market cycle has passed and that we are in the pace of a new cycle.

Maximize your Cointribune experience with our “Read and Earn” program! Earn points for every article you read and get access to exclusive rewards. Register now and start reaping the benefits.

After 7 years at a Canadian bank, 5 of which were in the portfolio management team as an analyst, I left my position to focus fully on financial markets. My goal is to democratize financial market information for the Cointribune audience on various aspects including macro analysis, technical analysis, intermarket analysis, etc.

DISCLAIMER OF LIABILITY

The comments and opinions expressed in this article are solely those of the author and should not be considered investment advice. Before making any investment decision, do your own research.