Michael Saylor, Executive Chairman of MicroStrategy, recently filed a notice with the Securities and Exchange Commission (SEC) about the sale of a significant portion of his MicroStrategy shares. The move, involving the sale of 310,000 MSTR shares worth $216 million, raises several questions. What motivations led him to this decision and will it have an impact on society?

Michael Saylor is selling MicroStrategy stock

Executive Chairman of MicroStrategy, Michael Saylor decided to sell part of his shares in the company represented by the ticker MSTR.

In a document filed on January 2, 2024 with the United States Securities and Exchange Commission (SEC) Michael Saylor said he plans to sell 310,000 of the 400,000 MSTR stock options he was granted in 2014.and which will expire in April 2024 if not used.

👉 Have you ever wondered: Who has the most bitcoins? Discover our Top 10 BTC Richest Entities

At the MicroStrategy Q4 conference Michael Saylor announced that he will be selling 5,000 shares of MSTR per day for the next 4 months, a total of 310,000 shares, equivalent to approximately US$216 million.

Since 2014, MicroStrategy’s stock value has increased significantly, largely due to the company’s investments in Bitcoin. First BTC purchase in 2020, MicroStrategy currently holds 189,150 BTC, which is 0.9% of all bitcoins in circulation.

MSTR shares have become a way for many investors and institutions to gain exposure to the price of Bitcoin in the absence of a spot Bitcoin ETF that correlates to the price of BTC.

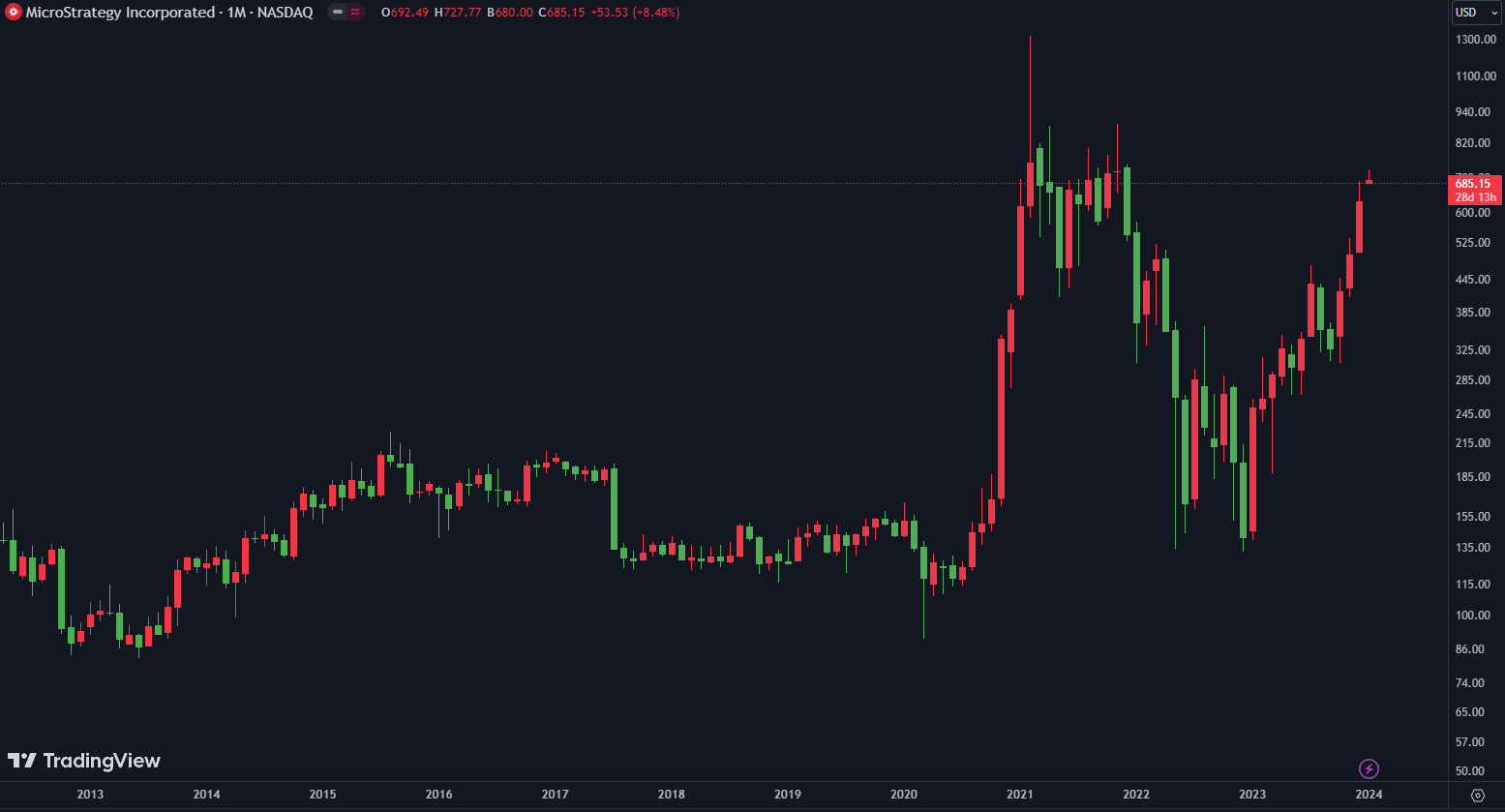

MicroStrategy (MSTR) stock price since 2014

Although the sale of 310,000 shares of MicroStrategy, a deal that represents nearly 2% of the total offering, may spook some investors, MSTR’s share price appears unaffected, even reaching its highest level since November 2021 at $727 per share.

This resilience can be explained by the strong dynamics that the cryptocurrency market has been in since the beginning of 2023. The year Bitcoin gained more than 150%, from $16,500 to $45,000. In parallel, MicroStrategy’s stock even outperformed the cryptocurrency queen, rising more than 330% from a low of $145.

From an investor’s point of view, it would be unreasonable not to make a profit after such a performance in such a short period of time. But is that the only reason Michael Saylor sold his shares?

Bitpanda: the ideal platform to diversify your investments

Why did Michael Saylor decide to sell his shares?

During the MicroStrategy Q4 conference Michael Saylor clarified that he sold these shares to meet his personal needs and also to purchase more bitcoins :

“For almost ten years now, the company has only paid me $1 salary at my request and I have decided that I will not be eligible for cash bonuses. Exercising this option will allow me to meet personal obligations and also get additional bitcoins to my personal account. »

👉 Also read in the news – Spot Bitcoin ETF: It could get the green light today

Then, to avoid panic among shareholders and to indicate that he no longer believed in the company’s future, emphasized his optimism about MicroStrategy’s prospects, recalling that he remains a significant shareholder in MSTR.

Zengo: an ultra-secure mobile wallet

Source: SEC

Newsletter 🍞

Receive a summary of crypto news every Monday by email 👌

What you need to know about affiliate links. This site may contain investment-related assets, products or services. Some links in this article may be affiliate. This means that if you purchase a product or register on a site from this article, our partner will pay us a commission. This allows us to continue to offer you original and useful content. Nothing will happen to you and you can even get a bonus using our links.

Investing in cryptocurrencies is risky. Cryptoast is not responsible for the quality of the products or services presented on this site and cannot be held responsible, directly or indirectly, for any damages or losses incurred after using the goods or services highlighted in this article. Investments related to cryptoassets are inherently risky, readers should do their own research before taking any action and invest only within their financial means. This article does not constitute investment advice.

recommendations of the AMF. There is no guaranteed high return, a product with high return potential involves high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose some of these savings. Do not invest unless you are prepared to lose all or part of your capital.

To go further, read our Financial Situation, Media Transparency and Legal Notice pages.