Activity on the Ethereum (ETH) network has increased significantly recently. But will it also have a positive effect on the price of ETH?

Ethereum asset price is on the verge of an upside breakout with chances of an upside reversal. However, to do so, ETH needs to break through the important Fibonacci resistance between $2,400 and $2,600.

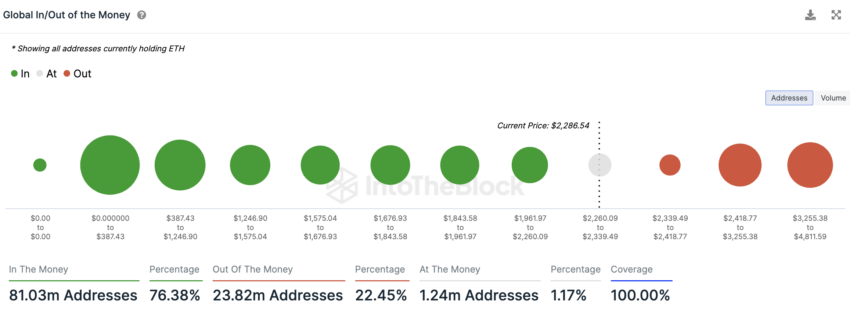

The vast majority of Ethereum addresses in profit

More than 76% of altcoin addresses are in profit with the current ETH price hovering around $2,200. Only 22.5% of ETH addresses are in the red, while around 1.17% of addresses are breaking even.

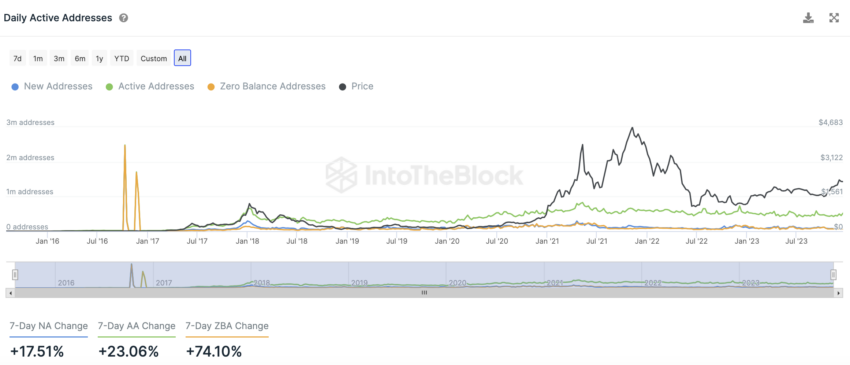

Ethereum network activity is booming

Ethereum network activity has increased significantly over the past seven days. The number of new addresses in the ETH network increased by roughly 17.5%.

The number of active addresses even increased by about 23%, while ETH addresses with no balance increased even by about 74%.

Learn more: How to buy Ethereum (ETH) and everything you need to know.

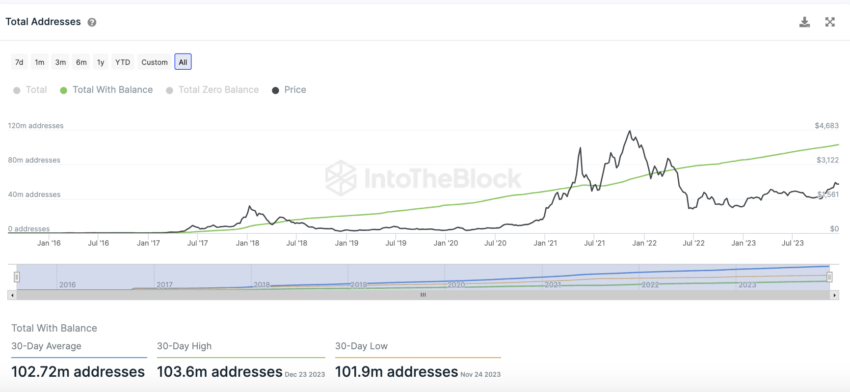

The total number of Ethereum addresses is in a stable uptrend. In the last 30 days, it was an average of 102.72 million addresses. That’s more than double that of Bitcoin (BTC).

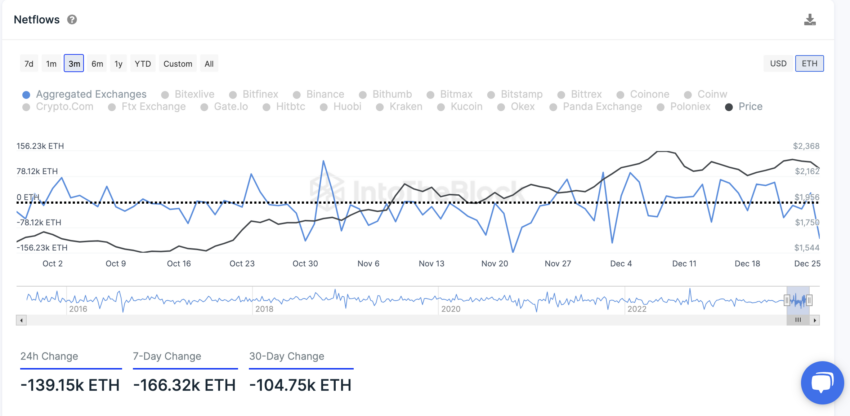

Increase in withdrawals on exchanges

Over the past seven days, approximately 166,320 more ETH have been withdrawn from crypto exchanges than deposited into them. Additionally, in the last 24 hours at the time of writing, the ETH balance of centralized exchanges has decreased by 139,150 coins.

This indicates that these tokens will be held and not released for trading purposes.

Who owns ETH tokens?

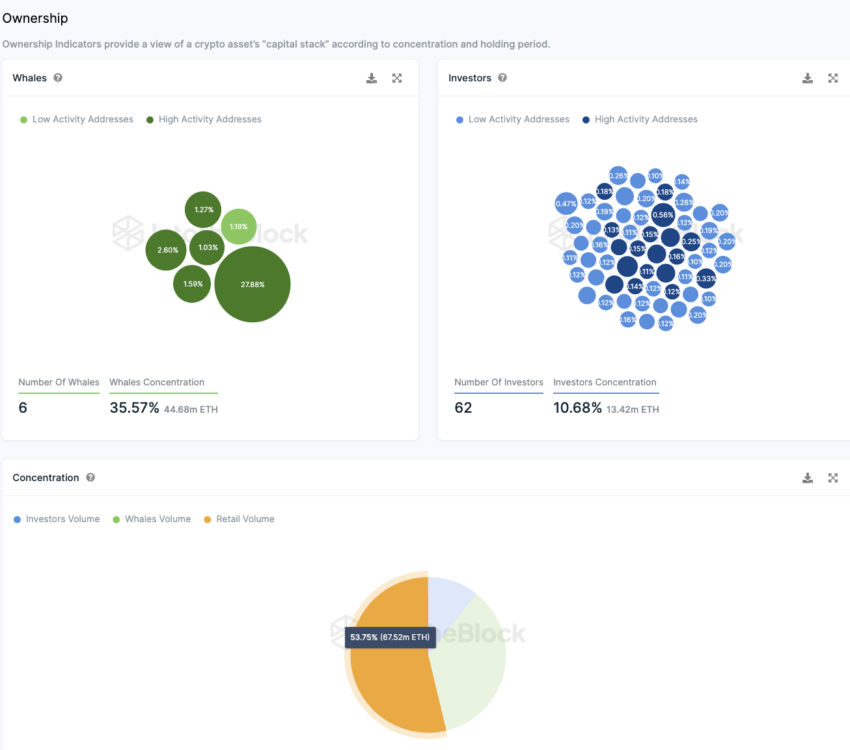

The majority of ETH (around 54%) is held by retail investors. These are addresses that each contain less than 0.1% of the supply. There are only six crypto whale addresses, each holding more than 1% of the supply.

Collectively, whale wallets represent approximately 35.6% of the token supply, a significant portion. It is important to mention that these players have a lot of market power.

A relatively large number of 62 addresses each hold between 0.1% and 1% of the ETH supply. Together, these major investor addresses hold approximately 10.7% of all available altcoin supply.

Moral of the story: Ethereum is more than just a token.

Disclaimer

Disclaimer: In accordance with The Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased information, but market conditions may change without notice. Always do your own research and consult with an expert before making any financial decision.